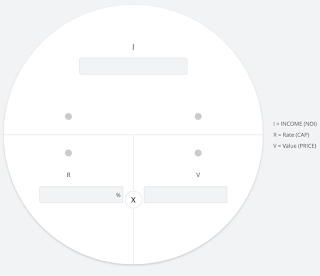

Cap Rate - Remember IRV

How Do I Calculate CAP Rate And What Is A CAP Rate?

Every beginner real estate investor is bound to ask questions like “What is a cap rate?” and “How do you calculate cap rate?”. This is because the capitalization rate (or cap rate, for short) is one of the most commonly used real estate metrics in the industry.

It’s one of the first numbers you’ll see when you begin to look at listings of investment properties. As you start to network, you’ll even find real estate investors discussing “What is a good cap rate?” and “What real estate markets give the best cap rates?”

It seems, then, that you can’t escape cap rates when you invest in real estate. The sooner you get the answer to “What is a cap rate?”, the sooner you can start your journey of investing in real estate and finding the best real estate investments.

What Is a Cap Rate?

When we talk about what is a cap rate, we are essentially talking about the return on investment of a potential real estate investment. When you calculate cap rate, you’re calculating the return on investment in terms of how much income is being made in comparison to the price of the investment property.

Usually, when real estate investors think of the net income, they take into consideration all of the investment property costs. This usually includes investment property financing. However, the cap rate is one of the real estate metrics which don’t factor in investment property financing. This is how cap rate is able to be listed for investment properties, as opposed to cash on cash return. It is independent of the individual real investor and totally dependent on the investment property.

What Affects a Cap Rate?

Clearly, cap rate differs from property to property and from location to location. So, there must be variables upon which the cap rate depends, the location and the investment property being two of them.

Location in the Real Estate Market

Location directly affects every investment property in the real estate market. This is because the success and therefore the value of an investment property is affected by the demand for it in the real estate market. Demand is affected by a few different factors in a location:

- The condition of the economy, industries, and companies

- The job market/employment rate

- Median household income

- Level of education

If a real estate market has positive trends for all of these elements, it makes investing in property there less risky. Therein lies what is a big factor in varying cap rates: the level of risk. Think of it in this way: when a real estate market has positive trends for all of these factors, that means demand for an investment property will be higher. With higher demand, there is less risk that a real estate investment will fail, making it a low-risk investment. Prices of investment properties will be driven up because of this high demand, and, therefore, in this same real estate market, you are likely to find lower cap rates. While this might mean higher prices compared to the amount of generated rental income, real estate investors are willing to take on these investment properties simply because they are more likely to succeed and are less risky.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

So, when you are asking what is a cap rate, you’re asking what is the level of risk. In theory, the higher the cap rate, the higher the risk. The lower the cap rate, the lower the risk.

Want to know where the best places to invest in real estate for a good cap rate are? Then read: Best Places to Invest in Real Estate Based on Cap Rate.

Type of Investment Property

The type of investment property will, of course, affect the risk and inherently affect the cap rate. For example, in many real estate markets, a single family home is considered the more stable real estate investment. In these specific real estate markets, the cap rate may be lower for single family homes when compared to multifamily homes or commercial real estate investment properties.

Interest Rates

Many real estate investors don’t realize that interest rates in a real estate market can affect the cap rate. Often, when what is a cap rate and what affects this real estate metric is discussed, interest rates are either glossed over or ignored. This is because the relationship is not a simple one. Yet, when interest rates change, so does the cap rate of your investment property.

Investment property financing, of course, affects the ability of anyone to borrow money and invest in real estate. What happens is this: as interest rates go up, even if nothing else changes about the real estate market or the investment property, cap rates go up as well. This is because as interest rates increase and debt service becomes more expensive, real estate investors will have to pay less for investment properties in order to achieve any kind of decent return on investment. A seller’s hand will be forced because of the state of the real estate market, and cap rates will go up as prices go down.

Interest rates are important to keep in mind as they affect cap rates and the value of your investment property. In fact, this is a predicted trend for the current real estate market.

How Do You Calculate Cap Rate?

Now that you know what is a cap rate, you probably have an idea of the cap rate formula:

Cap Rate = Annual Net Operating Income/Property Price

When you calculate cap rate, the annual net operating income (NOI) takes into account the rental income (and any other income you could possibly generate from the investment property). The expenses estimated from an investment property analysis are deducted (all excluding mortgage payments). This will give you the cap rate.

While the cap rate formula is simple to learn, it doesn’t make sense to manually calculate cap rate for every potential investment property. Why not use a cap rate calculator instead? This real estate investment tool will help you figure out cap rates easily and accurately.

Want more out of your cap rate calculator? Then use Mashvisor’s investment property calculator to calculate cap rate. Not only does it act as a cap rate calculator and quickly calculate cap rate for you, but Mashvisor’s investment property calculator will calculate cash on cash return, show your potential rental income and occupancy rate, and ultimately help you choose the best place to invest in real estate as well as the best real estate investments.

To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.

What Is a Good Cap Rate?

Now that you know what is a cap rate and how to calculate cap rate, you need to know how to make sense of the results. There is no clear answer as to what is a good cap rate. It is difficult to give a number in general. A real estate investor has to weigh all of the factors of the real estate investment deal at hand as well as his/her own financial situation and real estate investing goals.

There is one way to go about figuring what is a good cap rate. That’s by looking at the cap rate in a real estate market where you plan on buying investment property. You want the property to have a cap rate similar to that in the local real estate market. Of course, this is once you have analyzed the real estate investing potential for the real estate market and ensured that all the factors will support the success of an investment property.

Another rule of thumb: when selling, you want a low cap rate; when buying, you want a high cap rate (at least 5%). This is based purely on the purchase price of the property and should not be the rule that leads to your final decision.

When Should a Real Estate Investor Use Cap Rate?

Cap rates are used when selling and buying investment property. When a real estate investor is buying investment property, cap rates will be listed along with any homes for sale. This means they will be worth looking into. A smart move is to ask for the numbers used to calculate cap rate. This is because many times real estate investors trying to sell investment property can use exaggerated numbers in order to list more enticing cap rates. Calculate cap rate on your own for any potential investment.

When selling an investment property, you too will have to list cap rates and be prepared to answer “What is a cap rate?” for any interested buyers and new real estate investors. It will be easier to calculate cap rate for an owned investment property because you will have the exact NOI.

Is Cap Rate the Ultimate Real Estate Metric?

The short answer: no, the cap rate is not the “ultimate” real estate metric. While it can be a good measure of a return on investment, it needs to be used along with other real estate metrics, like cash on cash return.

Now that you know what is a cap rate, learn about another metric for return on investment: What Is a Good Cash on Cash Return?

Learning what is a cap rate and how to calculate cap rate is essential to every real estate investor’s education. Just keep in mind that when investing in real estate, there is no single number to look at. Any experienced real estate investor will tell you that an investment property needs to be analyzed from every possible aspect to ensure a good return on investment.

Author:

Please feel free to call/text me anytime.

ReplyDelete